Berlin’s housing market continues to defy European trends, with the latest BNP Paribas Real Estate report underscoring just how resilient and attractive the city remains for investors.

Vacancy at Historic Lows

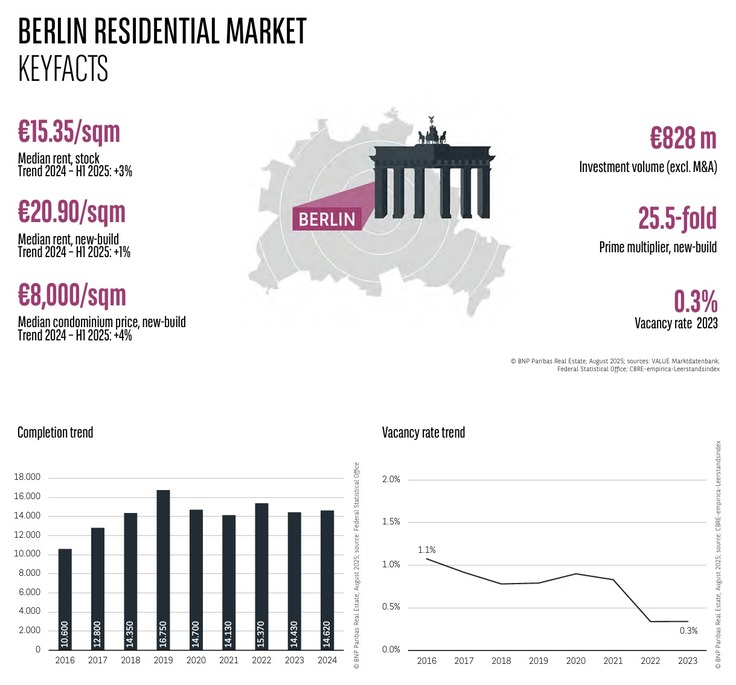

The city’s residential vacancy rate has fallen to just 0.3% in 2023, down from already scarce levels in prior years. In practical terms, in a city of 3.8 million people and 1.89 million residential dwellings, only a fraction of housing remains unoccupied. This sharp imbalance between supply and demand is the foundation of Berlin’s sustained market momentum.

Rental Growth Holds Steady

Median asking rents for existing stock rose +3% year-on-year to €15.35 per sqm, while new-build rents remained stable at €20.90 per sqm. Despite persistent challenges in construction and financing, the rental market demonstrates both resilience and upward pressure — particularly as completion rates are expected to decline further.

New-Build Condominiums See Price Gains

On the ownership side, new-build condominiums surged +4% in H1 2025 to €8,000 per sqm. This rebound highlights strong investor appetite, particularly for well-located assets in a market where supply shortages are only set to deepen.

Investment Momentum Returns

Berlin once again claimed the top spot among Germany’s residential hotspots, posting €828 million in transaction volume in the first half of 2025. The renewed activity signals a shift in sentiment, as international capital — including from U.S. investors — flows back into the German residential sector.

Outlook: Pressure Mounting, Attractiveness Rising

With fewer building permits being issued, completions are expected to fall sharply. This will intensify the imbalance between supply and demand, driving rents and prices further upward in the short to medium term. Against this backdrop, Berlin continues to present itself as one of Europe’s most dynamic, resilient, and investable residential markets.