Price Waterhouse Coopers and the Urban Land Institute release a report annually on emerging trends in the European Real estate sector by interviewing leading financial institutions and institutional investors in the property sector. For 2022, 844 industry professionals provided their feedback as to how they see the different European markets progressing this year.

A key element in the report this year was that there is a general consensus that the worst of the pandemic for the real estate industry is behind us and that real estate remains an attractive asset class.

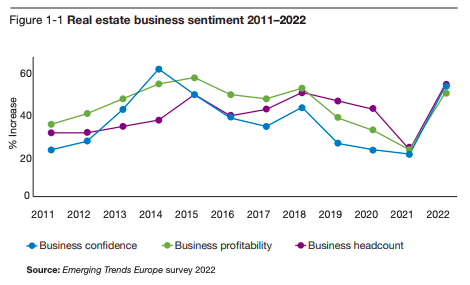

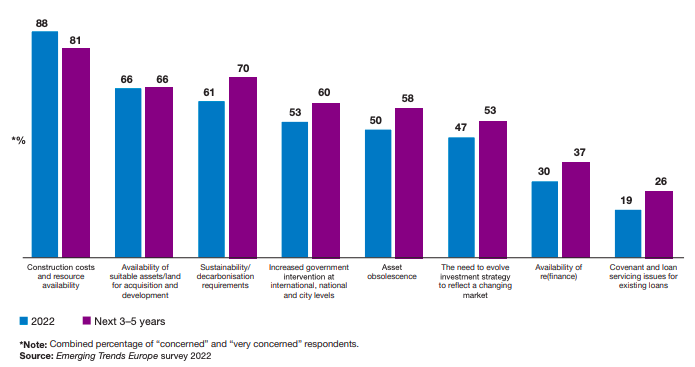

The support measures put in place by European governments and central banks has improved business confidence levels and profitability is expected to return to pre-covid levels. The biggest uncertainties across the real estate sector relate to inflation, energy costs and supply chains which will all directly impact construction prices and project delivery times.

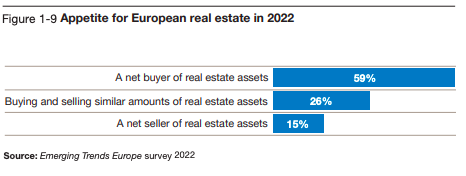

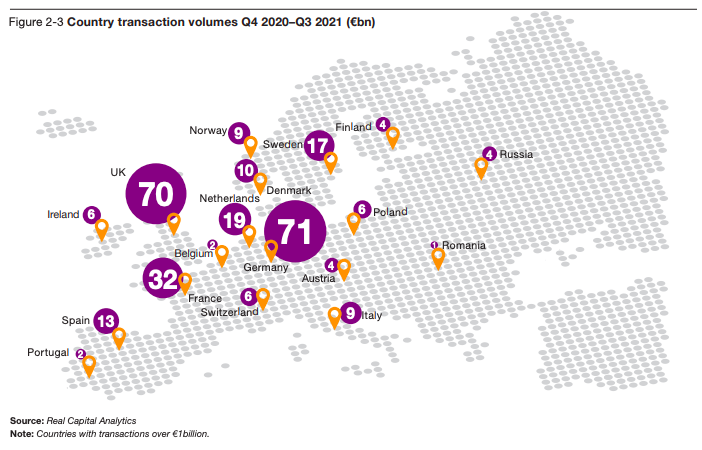

Demand still far outstrips supply across Europe and a majority of participants surveyed remain bullish on property as an asset class. This is further reinforced by transactional volumes being at all-time highs with Germany seeing the largest number of transactions at €71 Billion followed closely by the U.K at €70 Billion according to data from Real Capital Analytics.

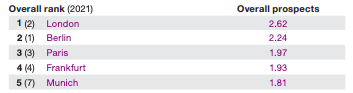

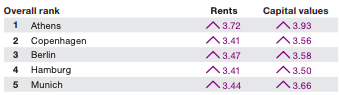

In terms of the most desirable markets for survey participants to invest in, Berlin and London have swapped places for the second year running however Berlin remains the only market that has held either 1st or 2nd position on this survey for the past six years. Three German cities, Berlin, Frankfurt and Munich feature on the top five. For rental and capital appreciation predictions over 2022, Athens surprisingly takes the top spot by a wide margin. This is explained by the fact that whilst Athens has a relatively low number of investors in the market, those that are investing believe the city offers some of the highest possible growth opportunities throughout Europe. As one private equity investor remarks “Greece, for the first time in decades, has a stable, pro-business government.”

Volsung will continue to focus on the Berlin market over 2022 with Ten Brinke having just acquired two new plots, one in Neukölln and another in Friedrichshain which we will be launching in the second quarter of this year. Given the turnaround of the economy in Greece since the financial crisis, a vibrant redevelopment planned at the old Hellinikon airport in Athens and the prospect of acquiring residency in Europe after the purchase of a property, we will be launching our first development in Elliniko, Athens this year.