BERLIN RESIDENTIAL INVESTMENT

2021-06-15 02:22:43 | INSIGHTS

CBRE, Berlin Hyp – Berlin Residential Market Report 2021

AUTHOR: Ian Sigmund

The CBRE, Berlin Hyp Berlin Residential Market report released on an annual basis is the most important report to dissect if you are considering investing into Berlin’s residential real estate market. It provides readers with a detailed breakdown of all the data and information they require to make an informed decision, not only as to whether to invest in Berlin but also which districts in the city might have the most attractive returns based on a variety of different factors from population growth, supply and demand dynamics to infrastructure and regeneration projects.

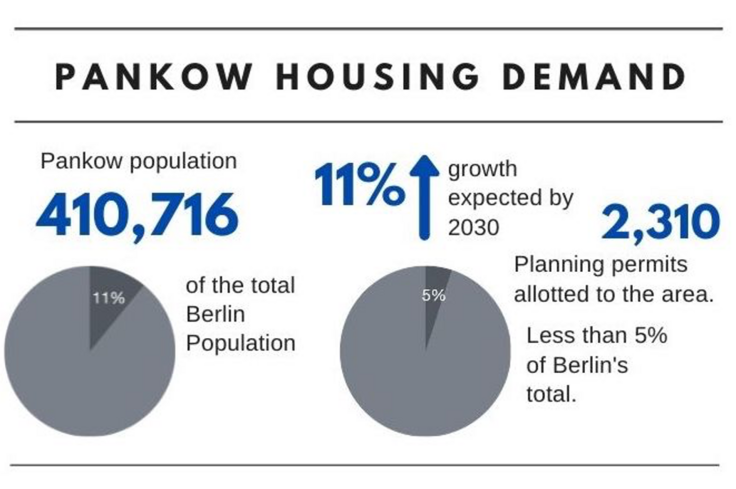

Pankow Pankow is one of the standout districts for population growth as it is expected to see the highest levels of growth, an expected 11% increase until 2030 and yet planning permits in this district are notoriously difficult to come by. CBRE’s data highlights that whilst there are 49,320 apartments currently in development in the whole of Berlin, despite Pankow having the largest population of any district in Berlin at 410,716 equating to 10.9% of those living in Berlin, the number of apartments under development in Pankow is only 2,310 in other words only 4.7% of the total. Treptow Köpenick on the other end of the spectrum is seeing a large amount of development with 8,910 units under construction, 18% of Berlin’s total whilst its population is only 276,165, 7.3% of Berlin.

Population growth As with all major cities around the world the population growth figures in Berlin were drastically lower over the year 2020, registering an increase of only 467 people. This contrasted sharply to the growth levels seen in the previous few years which ranged between 20,000 – 40,000 per annum. These low levels of growth are expected to continue until Germany can fully reopen its borders.

Infrastructure and Regeneration projects Europacity, Berlin Brandenburg airport, the old Tegel airport is being transformed into a centre for research and technology, Tesla is building an Automobile and Battery plant just outside the city next to the new international airport and Siemens is pumping 600m Euro into Siemens City that will be its global headquarters for Research and Development in key areas such as -

Siemens City 2.0 - Siemens is investing over 600m Euro into “Siemenstadt” district to drive their Research & Development activities ranging from distributed energy systems, energy management, EV technology, machine learning, artificial intelligence, data analytics and blockchain.

Tegel Tech Park – The old TXL Aeroport is being converted to a research and industrial park for urban technology spanning 495 hectares. This will consist of approx. 1,000 Companies, 20,000 employees and 5,000 students where the focus will be on environmentally responsible top-technologies for sustainable urban development.

Tesla Giga Factory – The Tesla Gigafactory will be the most advances high-volume electric vehicle production plant in the world upon completion at the end of 2021. The between 7,000 – 8,000 people working at the plan will be focused on developing Tesla’s most powerful battery systems along with high performance drive units and power electronics.

Europacity - One of the largest regeneration projects in Berlin centered around the Hauptbahnhof Berlin. The 61 hectare Europacity’s aim is to become the central business district for Berlin and will cater to over 16,500 employees with an additional 3,000 apartments upon full completion.

Residential market The residential market in Berlin saw a 7.4% growth spike in prices despite the Covid pandemic. This fundamentally comes down to the excessively low supply levels that have establish Germany’s capital having one of the lowest residential vacancy rates in the world at 0.8%. The luxury segment of the market has also firmly established itself with prices in Mitte and Charlottenburg-Wilmersdorf above the 10,000 Euro PSM level. Price growth in this segment veered towards the lower side with the locations trending between 6,000 – 8,000 Euro PSM experiencing the highest levels of growth. In order to buy an apartment that ranks in the top 10% of the most expensive apartments in Berlin you would need to pay a minimum of 7,680 Euro per square metre (PSM). This puts Berlin in only 5th position compared with Munich at 12,710 Euro PSM, Frankfurt at 9,430 Euro PSM, Hamburg at 9,000 Euro PSM and Stuttgart at 7,720 Euro PSM.

The rental market saw the average rentals drop by 2.8% however this was only because these figures consider the approx. 95% of housing stock that was subject to the Berlin rent freeze. These apartments were forced to reduce their rents beyond the federally mandated amount according to the “Mietpreisbrehmse.” When you consider the top segment of the market however which saw no additional regulations and prices are guided by the market, rents increased by 7% which is to be expected in a market with sub 1% vacancy rates. Looking forward to 2021 and beyond, developments centred around and with good transportation links to the largest infrastructure and regeneration projects will likely see standout growth within the market. However, with the prices of some new build developments in prime locations such as Mitte going for over 16,000 Euro PSM we will continue to focus on central locations within the S Bahn Ring priced where strong value can be achieved and with pricing between 6,000 – 8,000 Euro PSM.

AUTHOR:

Ian Sigmund

ian.sigmund@volsung.com

Similar Articles

2025-10-15 02:55:12 | INSIGHTS

A Strong Outlook for Sustainable Long-Term Growth

Germany’s Property Market

#GermanyProperty #RealEstateInvestment #BerlinProperty #EuropeanRealEstate #PropertyMarket #InvestmentOpportunities #GermanyEconomy #HousingMarket #MarketOutlook #PropertyGrowth #UrbanDevelopment #SustainableInvestment #PropertyTrends #LongTermGrowth #RealEstateInsights

2025-09-09 03:05:00 | INSIGHTS

Tesla Supercharges Berlin

A New Era of Growth for Property Investors

#TeslaBerlin #TeslaEurope #InnovationHub #TechGrowth #FutureOfMobility #InvestmentOpportunity #GlobalInvesting #SustainableGrowth #UrbanDevelopment #NextBigThing #BerlinRealEstate #PropertyInvestment #InvestInBerlin #RealEstateOpportunities #EuropeanProperty

2025-09-02 02:22:26 | INSIGHTS

Berlin's Vacancy Falls to 0.3% as Prices Push Higher

Berlin vacancy rate

#BerlinRealEstate #ResidentialMarket #PropertyInvestment #BerlinHousing #GermanRealEstate #RealEstateTrends #PropertyMarket2025 #UrbanLiving #HousingDemand #InvestmentOpportunities

2025-08-19 05:04:27 | INSIGHTS

Berlin Ranked 4th Globally for Rental Growth in 2025

Among the World’s Top 4 Cities for Rental Growth

#GermanHousingMarket #RealEstateInvestment #PropertyGrowth #HousingOpportunities #InvestmentInGermany #RealEstateTrends #HousingMarket2024 #PropertyInvesting #RentalMarketGrowth #SustainableInvestments #GermanyRealEstate #HousingSupplyDemand #PropertyAppreciation #RealEstateOpportunities #RealEstateGains

2025-08-12 07:01:29 | INSIGHTS

Germany’s Rental Market in 2025

Where Prices Are Rising the Fastest

#GermanRentalMarket #GermanyHousing #BerlinRents #HousingCrisis #RentIncrease #RealEstateGermany #LivingInGermany #CostOfLivingGermany #GermanyProperty #HousingMarketTrends #RentVsBuy #UrbanLiving #PropertyInvestmentGermany

2025-05-27 04:14:40 | INSIGHTS

Germany’s Property Market Gains Momentum in 2025

German Property Market 2025

#RealEstate #Germany #PropertyMarket #Investment #2025Trends #PositiveOutlook #HousingMarket #CommercialRealEstate #LinkedInNews #EconomicGrowth

2025-04-28 04:33:33 | INSIGHTS

Germany's Residential Investment Market Rebounds in Q1 2025

Signs of a Stronger Year Ahead

#germanrealestate2025 #GermanHousingMarket #RealEstateInvestment #PropertyGrowth #HousingOpportunities #InvestmentInGermany #RealEstateTrends #HousingMarket2025 #PropertyInvesting #RentalMarketGrowth #GermanyRealEstate #HousingSupplyDemand #PropertyAppreciation #RealEstateOpportunities #RealEstateGains

2025-03-03 03:13:11 | INSIGHTS

Exploring Germany's Real Estate Market

A Guide for Investors

#GermanHousingMarket #RealEstateInvestment #PropertyGrowth #HousingOpportunities #InvestmentInGermany #RealEstateTrends #HousingMarket2024 #PropertyInvesting #RentalMarketGrowth #SustainableInvestments #GermanyRealEstate #HousingSupplyDemand #PropertyAppreciation #RealEstateOpportunities #RealEstateGains

2025-01-14 02:08:21 | INSIGHTS

European Real Estate Market Gaining Momentum Heading into 2025

Market review for 2025

#2025 #realestate #Europerealestate #rentalmarket #berlin #germany #marketgrowth #bestinvestements

2024-12-03 06:14:09 | INSIGHTS

Germany’s Housing Market

A promising Rebound in 2024

#GermanHousingMarket #RealEstateInvestment #PropertyGrowth #HousingOpportunities #InvestmentInGermany #RealEstateTrends #HousingMarket2024 #PropertyInvesting #RentalMarketGrowth #SustainableInvestments #GermanyRealEstate #HousingSupplyDemand #PropertyAppreciation #RealEstateOpportunities #RealEstateGains

2024-10-27 04:15:43 | INSIGHTS

Blog Positive Outlook for the German Housing Market in 2024-2025

Blog Positive Outlook for the German Housing Market in 2024-2025

German

2024-10-27 04:13:11 | INSIGHTS

Germany's inflation rates declined

Germany's inflation rates declined

German

2024-10-27 04:10:35 | INSIGHTS

Berlin growth by 2045

Berlin growth by 2045

#Berlin #PopulationGrowth #EconomicStrength #FutureTrends #UrbanDevelopment

2024-10-26 07:27:15 | INSIGHTS

Trust in Off Plan Investment with Ten Brinke - Proven Success in Berlin

Trust in Off Plan Investment with Ten Brinke - Proven Success in Berlin

#RealEstateInvestment #OffPlanSuccess #BerlinDevelopments #TenBrinke #PropertyInvestment #RealEstate #UrbanLiving #SustainableLiving #HighReturns #InvestmentOpportunity

2024-10-26 06:33:05 | INSIGHTS

Successfully Completed Projects

Successfully Completed Projects

Projects

2024-10-26 04:04:44 | INSIGHTS

Euro-Zone Activity 04.06.2024

Euro-Zone Activity 04.06.2024

Euro

2024-10-26 04:02:07 | INSIGHTS

Euro-Zone Economy Set to Accelerate as Germany Bounces Back

Euro-Zone Economy Set to Accelerate as Germany Bounces Back

German

2024-10-26 03:59:55 | INSIGHTS

German vs. UK Tax

German vs. UK Tax

German

2024-10-26 03:57:33 | INSIGHTS

Understanding the Demographics of Berlin

Understanding the Demographics of Berlin

Berlin

2024-10-26 03:55:26 | INSIGHTS

Berlin’s Housing Market Opportunities for Sustainable Growth

Berlin’s Housing Market Opportunities for Sustainable Growth

Berlin

2024-10-26 01:03:56 | INSIGHTS

Skyrocketing Demand, Soaring Prices The German Real Estate Boom

Skyrocketing Demand, Soaring Prices The German Real Estate Boom

German

2024-10-25 00:37:10 | INSIGHTS

Introducing Berlin A Hotspot for Real Estate Investment

Introducing Berlin A Hotspot for Real Estate Investment

Berlin

2023-07-07 06:17:04 | INSIGHTS

Berlin rent control explained

What you can and cannot do as a buy to let landlord

Berlin residential invesment

2023-06-09 04:48:19 | INSIGHTS

A comprehensive guide to letting an apartment in Berlin

Buy-to-let made easy

Berlin residential invesment

2023-05-09 04:15:31 | INSIGHTS

A review of the 2023 CBRE, Berlin Hyp Housing Market Report

Is Berlin still a good investment?

BERLIN RESIDENTIAL INVESTMENT

2023-04-25 06:50:02 | INSIGHTS

Is buying property in Berlin a good investment?

A prediction of possible returns on investment in Berlin real estate

BERLIN RESIDENTIAL INVESTMENT

2023-03-30 03:10:23 | INSIGHTS

Why invest in Berlin with Volsung & the Ten Brinke Group?

An in depth view

Berlin residential investment

2023-03-16 05:29:09 | INSIGHTS

How to obtain financing as a foreign investor in Germany

Your options in 2023

Berlin residential invesment

2023-02-24 05:20:13 | INSIGHTS

Berlin Residential Real Estate Market Update

Outlook for 2023

Berlin residential investment

2023-02-20 06:47:54 | INSIGHTS

Berlin, first time investors guide

How to invest in Berlin as a foreigner

Berlin residential investment

2022-05-17 02:53:12 | INSIGHTS

Real Estate investment in Berlin, 2022

CBRE, Berlin Hyp, Berlin Residential Market Report 2022

BERLIN RESIDENTIAL INVESTMENT

2022-02-22 04:04:59 | INSIGHTS

Savills: World Cities tracks the performance of 30 global cities

Is now the time to invest in Berlin?

BERLIN RESIDENTIAL INVESTMENT

2022-01-24 08:24:35 | INSIGHTS

PWC & ULI Emerging Trends Europe - 2022 Report

Volsung's key takeaways

BERLIN RESIDENTIAL INVESTMENT

2021-09-28 03:14:54 | INSIGHTS

Berlin's Fintech ecosystem

Further proof that Berlin is a strong investment

BERLIN RESIDENTIAL INVESTMENT

2021-07-16 02:55:44 | INSIGHTS

Berlin real estate investment. FAQ

How to invest in the Berlin real estate market

BERLIN RESIDENTIAL INVESTMENT

2021-06-25 07:33:24 | INSIGHTS

Bnp Paribas - European property market outlook

Volsung's key takeaways

BERLIN RESIDENTIAL INVESTMENT

2021-06-18 06:45:43 | INSIGHTS

Berlin 'best growth prospects of any city in Europe this year.'

Volsung's key takeaways from the PWC & ULI report.

BERLIN RESIDENTIAL INVESTMENT

2021-06-18 03:32:28 | INSIGHTS

Why invest in Berlin?

Our top four reasons for investing

BERLIN RESIDENTIAL INVESTMENT

2021-06-18 02:28:59 | INSIGHTS

Berlin's booming economy

Why does Berlin make for such a secure investment?

BERLIN RESIDENTIAL INVESTMENT