When it comes to international real estate investment, the tax implications play a pivotal role in the decision-making process. While the U.K.'s real estate market has long been a global hotspot for investors, Germany's market has emerged as an increasingly attractive option, largely due to its favourable tax regime. In this article, we will explore why investing in German real estate can be more advantageous from a tax perspective when compared to the U.K., considering market supply, tax implications, and financing options.

- The Underlying Market Conditions

Before delving into the intricate world of tax, an investor must first consider the basic principle of supply and demand. Germany, particularly in urban areas like Berlin, Frankfurt, and Munich, has been grappling with a housing shortage. This imbalance between supply and demand has buoyed the rental market, creating a fertile ground for real estate investors. The U.K. market also boasts strong demand, but efforts to increase housing supply could potentially temper yields in the long term.

- A Closer Look at Tax Implications

The true appeal of German real estate investment becomes apparent when examining the tax treatment of property income and capital gains.

- Capital Gains Tax: A Decisive Advantage

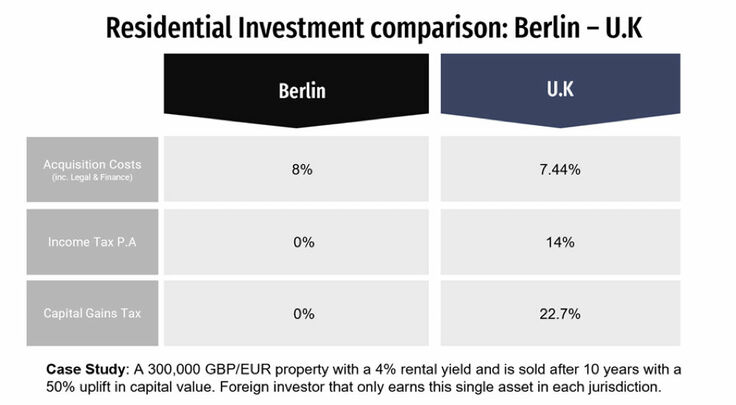

One of the most compelling tax advantages in Germany is the exemption from capital gains tax for properties held for more than ten years. For investors with a long-term strategy, this exemption can result in significant savings. In contrast, the U.K. imposes a capital gains tax of 20% for basic rate taxpayers, rising to 24% for higher-rate taxpayers on gains exceeding £50,270. Thus, a 50% capital appreciation over ten years would be fully tax-exempt in Germany, but subject to tax in the U.K.

- Rental Income Taxation: Deductions Make a Difference

The German tax system offers a range of deductions that can reduce the taxable income from property rental. These include mortgage interest, a 2% annual depreciation for the property, and management fees. These deductions significantly lower the tax burden on rental income.

In the U.K., the ability to deduct mortgage interest has been phased out, and only management fees and service charges are generally deductible. This change has resulted in a higher effective tax rate on rental income for many investors.

- Acquisition Costs: An Initial Consideration

It's important to note that the acquisition costs, including legal and mortgage arrangement fees, are generally higher in Germany than in the U.K. However, when considering the long-term tax benefits, these upfront costs are often justified.

- Financing Options: The Backbone of Investment

Germany's mortgage market is known for its favorable rates, and obtaining financing as a foreign investor is relatively straightforward. While the U.K. also offers various financing options, recent tax changes have made the market less favorable for landlords, especially those with mortgages.

- Projected Returns: A Comparative Analysis

Based on the outlined assumptions, a property investment in Berlin would result in a return of €270,000 after ten years. An equivalent investment in the U.K. would yield £219,150. This considerable difference is primarily attributed to Germany's benevolent tax system, which offers full capital gains tax exemption and more extensive deductions for rental income.

- Conclusion: Long-Term Planning Pays Off

While German real estate investment might come with higher initial costs and a complex set of laws and regulations, the long-term tax advantages are clear and can lead to significant financial benefits. Investors seeking to maximize their returns and minimize their tax liabilities would do well to consider Germany's real estate market, particularly for long-term investment horizons.

However, it's crucial for investors to seek the advice of tax professionals and perform comprehensive due diligence. Tax laws are intricate and can change, and while this article provides a general overview, individual circumstances can substantially impact tax outcomes. With careful planning and expert advice, German real estate investment can be a wise choice for those looking to expand their international investment portfolio.