When looking at your options for investment in real estate, Berlin may not be the first city which comes to mind. London, for example, is well trodden ground which, for the most part, is considered stable & guaranteed to give returns.

Here we’re going to break down why Berlin is one of the best cities for investors, why now is the time to invest and finally why you should invest with Volsung & the Ten Brinke group.

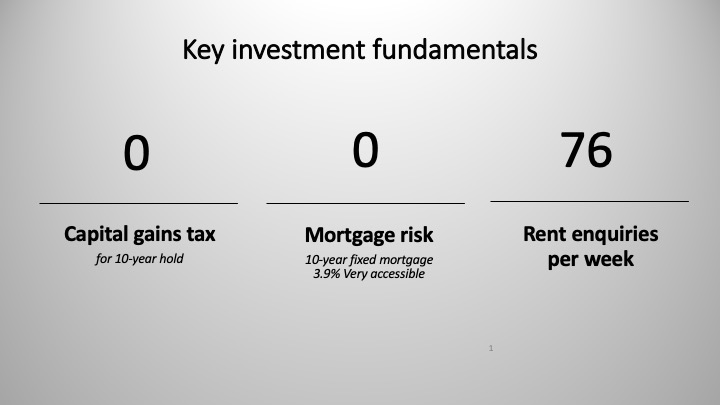

Before getting into the potential returns Berlin offers, there are 3 non-negotiables which must be ticked - Is the tax manageable? Can I get financing? Can I rent it out quickly in order to pay my mortgage?

Berlin is a yes for all of these.

Developing economy & price growth

To truly understand the potential of Berlin it is important to put the city in context.

Germany has the largest economy in Europe and the 4th largest globally. Berlin is the political centre of the country and despite the fact that it has been ranked either 1st or 2nd in PriceWaterhouseCoopers & Urban land institute's best cities to invest since 2015, it is still one of the most undervalued cities in the world.

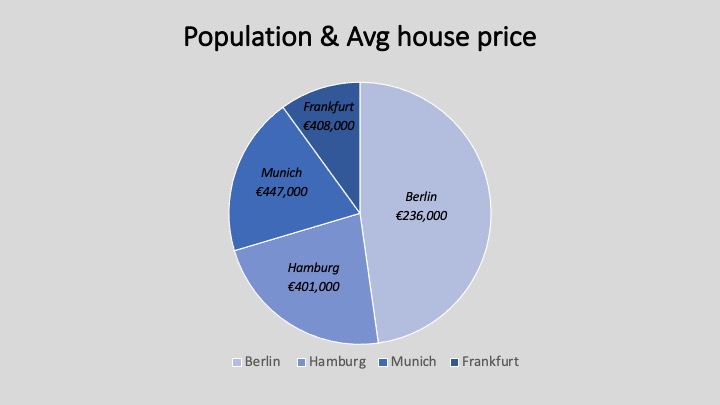

How does this play out in terms of real estate? Berlin has a population of almost 3.8 million people, far greater than any other of Germany's key cities, and yet the average house price is currently far less, 12th on the list.

Why have all the other major German cities seen such growth and Berlin lags behind?

Post World War II Germany's major cities re-invented themselves & focused on key sectors to drive growth. Munich has the service sector, Frankfurt is dominated by the finance sector & Hamburg is important in both Aviation & Logistics.

However it wasn’t until the Berlin Wall fell that Berlin was able to flourish. Since then we have seen impressive growth but it is still in its infancy compared with others.

What does the Berlin market look like today?

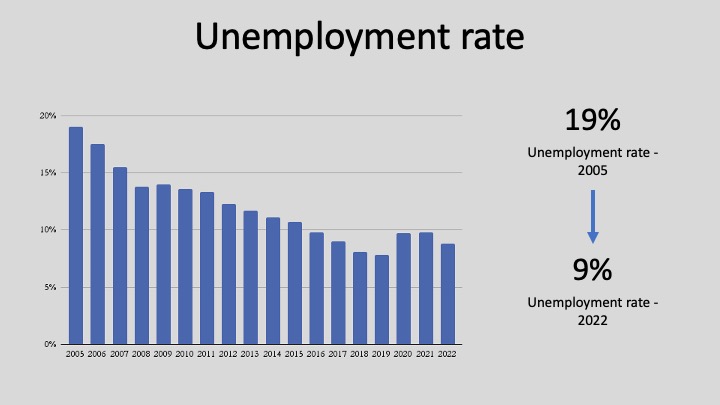

In 2005 Berlin had an unemployment rate of 19% which is incredibly high for a western European capital. That all changed in the mid 2000's when the city's unemployment started dropping at the fastest rate of any city in Europe within a ten year period. This is in part down to the fact that it was at that time that Berlin found its sector, putting every resource into becoming a world leader in digital & tech and is now considered the digital & tech hub of europe. Currently as many as 1 in 7 people are employed in the tech and media sector.

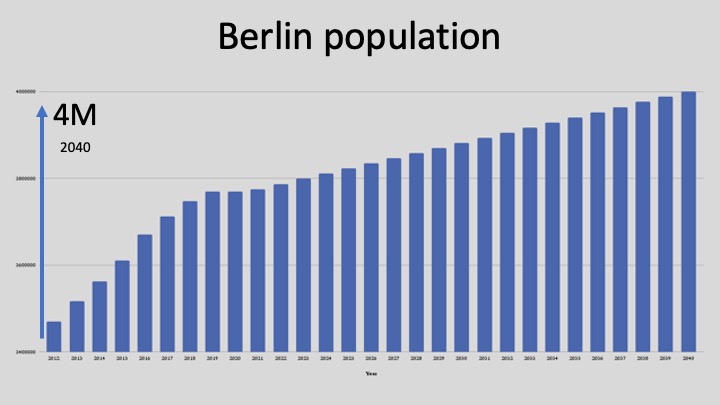

This was initially down to start-ups as Berlin lacked an international airport putting off bigger companies. The newly completed Brandenburg airport solves that problem & Berlin is seeing an influx of big tech moving to the city. The airport offers long haul flights to other business hubs and is set to serve 55 million passengers by 2040. The change the airport brings is already showing with the likes of Amazon & Tesla setting up shop.

What is exciting is that this is happening in real time, investing in Berlin now puts you ahead of the price growth which is sure to come. Unlike other powerhouses such as London or Paris, Berlin has not yet hit its peak.

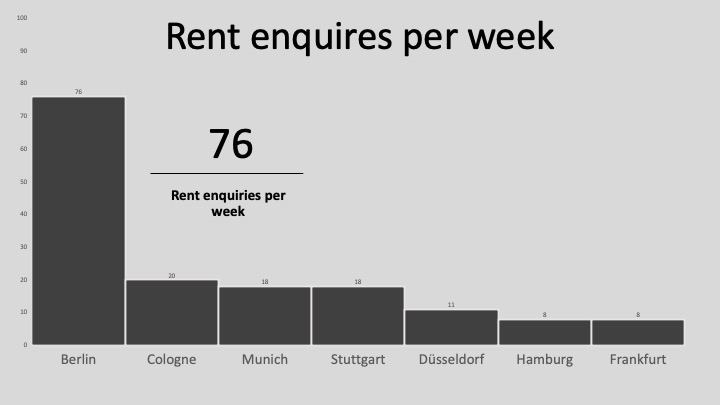

Rising population & undersupply of housing

With the arrival of these huge multinationals and the employment opportunities that come alongside, expats are flooding to Berlin and the population is set to increase by 4m by 2040. The residential sector was not prepared for this growth, illustrated by Berlin’s vacancy rate of just 0.9%. To put that into context, London has a 2.7% vacancy rate. As expected, due to undersupply, the market has seen consistent capital growth of approx. 10% each year since 2016. A rental growth of 4-7% is expected over the next 5-7 years.

How did this bottle neck happen? Prior to 2014 Berlin had a strict rent control policy which to some extent still exists today. Any apartment built prior to 2014 is still subject to rent control which means that local Berliners who have been living in a well located apartment for some time are unlikely to move.

Any apartment built post 2014 is not subject to rent control which means that they are hot property for any expat moving to the city because there are so few other options available. The other factor which adds to the issue is that planning permits are notoriously difficult to get, even more so than london. Which means there are very few new builds available.

This creates a perfect environment for investors,as laid out in Bloomberg’s latest article;

“The tech sector helped create the city’s housing crunch by hiring thousands of software coders and engineers with salaries higher than most locals. Since the mid-2000s, when Berlin’s tech boom got going, the population has climbed by more than 300,000 people and rents have more than doubled.

Berlin’s new tech recruits are told to take any apartment they can get, even if it's nowhere near the trendy neighbourhoods that may have lured them to the German capital”

Tax advantages -

As mentioned at the beginning of this article Berlin has some fantastic tax advantages.

The government favours a stable market and therefore will actually reward you for holding your property. Meaning that if you hold your property for 10 years you will pay zero capital gains tax. The 10 years starts from the day you exchange so depending on completion date, by the time you start paying off a mortgage you could already be a couple of years in.

Why invest with Volsung & the Ten Brinke group?

When investing in property it is as much about the company you choose to invest with as it is the property & the city. There are many horror stories about incomplete buildings and dragged out completion dates which cost investors time and money.

Volsung is part of the Ten Brinke group, one of the largest developers in Europe. It is a 120 year old family business active in the residential, office, healthcare, retail, logistic & healthcare sector, in 2022 their revenue was over 1 billion Euro.

Volsung is the international distribution channel mandated with approaching retail & institutional investors. Being part of this group gives us a great advantage, it means we can offer investors the best price possible as all areas of development are done in house. It also means we can offer a quality product that will be delivered on time & to specification.

We are here to guide you through every step of the acquisition process, ensuring access to financing, successful handover & tenancy of the final asset. If you are interested in investing, don’t hesitate to reach out.