As the demand for residential properties in Germany continues to soar, a significant imbalance between supply and demand is becoming increasingly apparent. The key factor driving the continuous rise in residential prices across the country lies in the insufficient rate of new construction to meet the growing needs of the population.

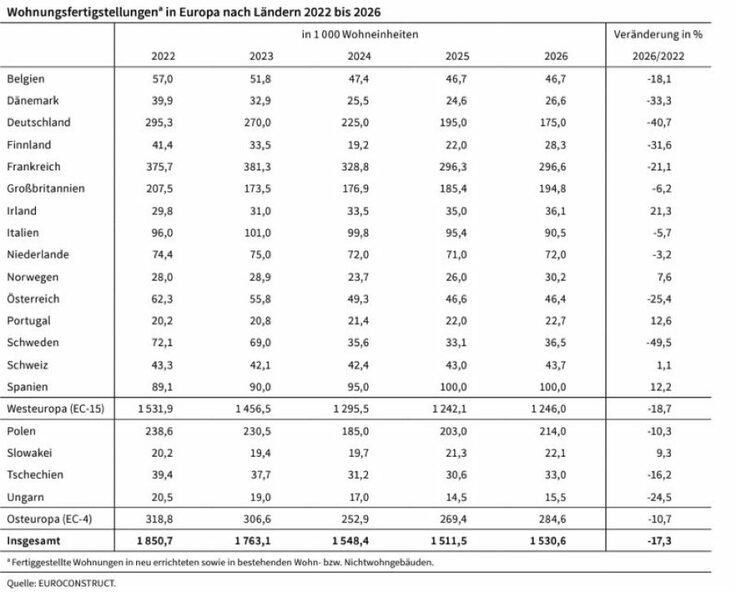

A telling indicator of this trend is illustrated in the graph showcasing the number of residential apartment completions projected from 2022 to 2026. Despite Germany's larger population compared to countries like Poland, France, and the UK, the disparity in the number of new residential units being built is striking. Poland, a country with less than half the population of Germany, is set to surpass Germany in apartment completions starting from 2025. Similarly, France, with a smaller population, is on track to construct nearly half as many residential units as Germany, while the UK is projected to overtake Germany in new constructions by 2026.

Inevitably, this shortage of supply in the housing market is expected to lead to a surge in both capital growth and rental prices in Tier 1 cities across Germany. With residential vacancy rates consistently ranking among the lowest in the world, the competition for available properties is intensifying, further driving up prices.

As a result, investors and homeowners alike are witnessing a lucrative opportunity in the German real estate market, with the potential for substantial returns on investment. The scarcity of residential properties coupled with robust demand is creating a favorable environment for sustained growth in property values, making Germany an attractive destination for real estate investment.

In conclusion, the ongoing imbalance between supply and demand in the German housing market is poised to fuel a continuous upward trajectory in residential prices. With a limited number of new constructions in the pipeline to address the growing demand, Tier 1 cities in Germany are expected to experience a significant appreciation in property values and rental rates, solidifying the country's position as a hotbed for real estate investment opportunities.