LinkedIn Post (copied):

In 2022 Berlin’s population grew by a whopping 77,800. That equates to a population increase of 2.1%. The permits for residential units that year? 17,165.

The demand for rental properties in Berlin remains as strong as ever primarily fuelled by the cities’ 0.8% residential vacancy rate. There can be no doubt that the city does not have enough housing and many of the tenants that have moved into our latest developments had been living in hotels (paid for by their companies) as they were unable to find anywhere suitable to rent.

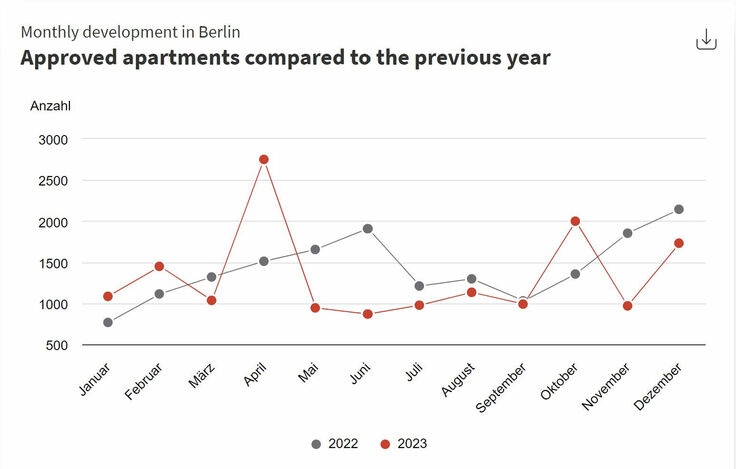

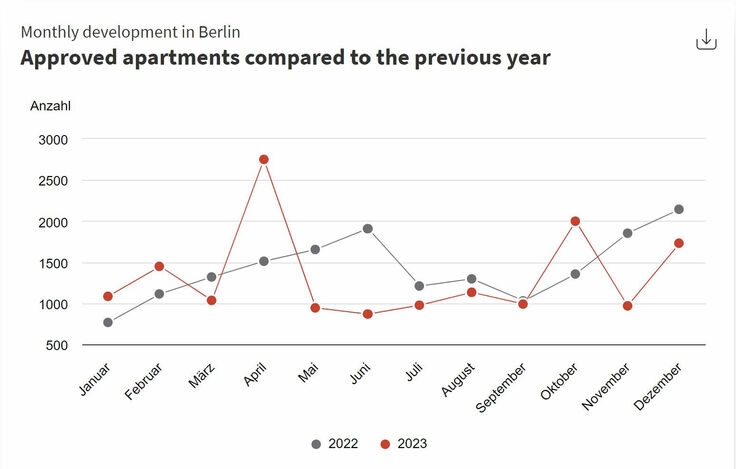

What is needed to address this is a dramatic increase in the number of apartments built and by extension more building permits issued. The rise in interest rates has meant that it is more and more difficult for developers to profitably build and since May of 2023 we are beginning to see a trend of considerably lower number of building permits approved. This will ultimately mean less new apartments per year whilst the population growth in Berlin remains robust.

The easiest way for the government to encourage growth in the building sector would be to relax some of the requirements on developers for multifamily homes. Whilst the requirement for a certain percentage of a development as playground space along with at least 2 bike spaces per apartment is a great concept, for some sites it simply isn’t viable. These stringent planning requirements are making it more and more difficult for developers to add new supply to the market and we expect to see the vacancy rates drop even further over the next two years leading to another jump in the rental market.

Source: https://lnkd.in/dN5K9Xce

Source: https://lnkd.in/ddQSqgBu

Introducing Berlin: A Hotspot for Real Estate Investment

Berlin, the vibrant capital of Germany, is making waves in the real estate market with its undeniable allure and promising growth. In 2022 alone, the population of this dynamic city swelled by over 80,000 residents, a remarkable 2.1% increase that speaks volumes about its popularity and potential.

While property prices may be experiencing a downturn in many other German cities, Berlin stands out as an exception, with prices on a steady upward trajectory. The recent acquisition of a 1,000-unit development by CBRE for a staggering 357 million Euro in the fourth quarter of 2023 is a clear indicator of the unwavering interest from institutional investors, undeterred even by rising interest rates.

What sets Berlin apart is not just its soaring property market, but also its incredibly low residential vacancy rate of 0.8%, making it a highly sought-after destination for residents and investors alike. The city boasts a thriving media and tech sector, further adding to its appeal and economic vitality.

For those looking to make a sound investment, newbuild properties are the way to go. According to a survey by real estate financing platform Europace, prices for older buildings in Germany have been on a decline, largely due to the risks associated with renovation costs and existing tenant agreements. In contrast, newbuilds offer a more attractive option with modern amenities and promising returns.

In conclusion, Berlin's real estate market presents a golden opportunity for buyers and investors looking to capitalize on a robust and flourishing market. With its strong fundamentals, competitive pricing, and bright future prospects, Berlin is indeed a gem in the European real estate landscape. Don't miss out on being a part of this exciting journey!

(Source: https://lnkd.in/dTwakG9f)

Title: Unveiling Berlin: Your Gateway to Thriving Real Estate Investments

In the ever-evolving landscape of real estate, Berlin stands out as a beacon of opportunity, with its population surging by over 80,000 residents in 2022, marking a remarkable 2.1% increase. While property prices in various German cities may be experiencing a downturn, Berlin continues to defy the odds with its prices steadily on the rise.

A recent headline-making acquisition by CBRE of a 1,000-unit development for a staggering 357 million Euro in the fourth quarter of 2023 underscores the unwavering interest from institutional investors, signaling a strong vote of confidence in Berlin's real estate market. Despite the rise in interest rates, appetite from investors remains strong, bolstered by the city's unique appeal and growth potential.

One of the key factors that sets Berlin apart is its incredibly low residential vacancy rate of 0.8%, making it a highly coveted destination for both residents and investors. The city's vibrant media and tech sector further contribute to its economic vitality, offering a diverse range of opportunities for growth and development.

For those looking to make a solid investment, newbuild properties emerge as the clear winner. Older buildings, with their associated risks of renovation costs and existing tenant contracts, have seen prices falling across Germany. In contrast, newbuild properties offer modern amenities, promising returns, and a more attractive investment proposition.

In conclusion, Berlin's real estate market presents a golden opportunity for investors and homebuyers seeking to capitalize on a market brimming with potential and promise. With its strong fundamentals, competitive pricing, and bright future prospects, Berlin emerges as a standout destination for those looking to make their mark in the European real estate arena. Embrace the journey and seize the opportunities that Berlin has to offer!

(Source: https://lnkd.in/dTwakG9f)