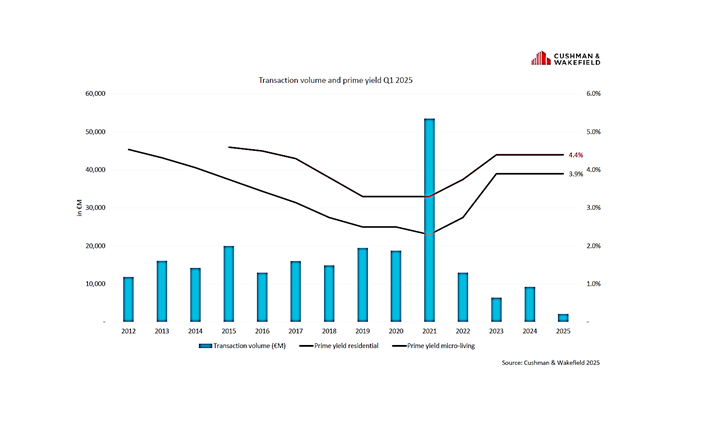

Germany’s residential investment market is showing promising signs of recovery in early 2025, marking a notable shift after a challenging year in 2023. According to Cushman & Wakefield, the first quarter of 2025 saw a significant uplift in transaction volume, with residential investments reaching approximately €1.6 billion—more than double the amount seen in the same period of 2024.

This positive momentum stems largely from falling interest rates and improved financing conditions, which are helping to revive investor confidence. With a healthier economic outlook and greater market stability, both domestic and international investors are returning to the residential sector, particularly in major urban centers such as Berlin, Munich, and Hamburg.

What’s Driving the Market Shift?

Cushman & Wakefield highlights several factors behind this uptick:

- Lower Interest Rates: The European Central Bank’s easing of monetary policy has led to improved lending terms, unlocking more capital for real estate investments.

- Stabilizing Prices: After a period of correction, residential property prices are stabilizing, offering better entry points for buyers.

- Urban Demand: Continued demand for housing in Germany’s top cities is underpinning investor interest in multi-family units and residential portfolios.

What to Watch in 2025

The full-year outlook remains cautiously optimistic. If financing conditions continue to improve and inflation stays in check, 2025 could see a return to long-term average investment volumes. The report also suggests that more portfolio deals may emerge in the coming quarters, further supporting transaction activity.