1 - Why Invest in Berlin?

The most obvious reason to buy a residential apartment in Berlin is that from a supply standpoint it has one of, if not the lowest, residential vacancy rates in the world for a capital city at only 0.9%. This tight supply has led to both strong capital and rental growth in the city which is expected to persist for the long term, with planning permits increasingly difficult to come by and no solution to add more supply onto the market in sight.

2 - What are the Acquisition Costs in Berlin?

Transfer tax – 6%

Land Reg – 0.5%

Notary – 0.5%

Legal – 1%

Total Acquisition costs: 8%

3 - Do I need to pay Agency Fees in Berlin and if so what is the market standard?

The agency fees that may be charged to the buyer differ in Germany’s various states. In Berlin these have been lowered recently, so the maximum amount that may be charged is 3.57% on top of the purchase price. This amount is inclusive of VAT.

It is a group wide policy at Ten Brinke (our developer partners) that no agency or consulting fees may be charged by any agents on top of the purchase price for any Ten Brinke developments.

4 - There is already a notary involved, do I need a lawyer?

It is law in Germany that a notary be present at the signing of contracts otherwise known as notarisation. This notary does not represent either the buyer or seller and whilst they will answer basic questions they are legally not allowed to provide opinions or input on any aspect of the purchase. Their function is primarily associated with working with the land registry and creation of the land folios. A lawyer is needed on the client's side, working with banks for mortgage disbursements, helping with handover of keys. Any issues or questions that might arise the lawyers will be there to help from signing to completion of the project.

5 - Are there Rent Controls in Berlin?

There are rent controls on all residential apartments in Germany that were built prior to 2014. The rents for these apartments must follow rules set out by the German Government which determine the amount of rent that can be charged as well as in what circumstances and how much this rent can be increased. Typically speaking the rents for apartments built after 2014 will be between 50% - 75% higher than those under rent control, but this can end up 100% or more in prime locations.

6. Is there Tax on Rental Income?

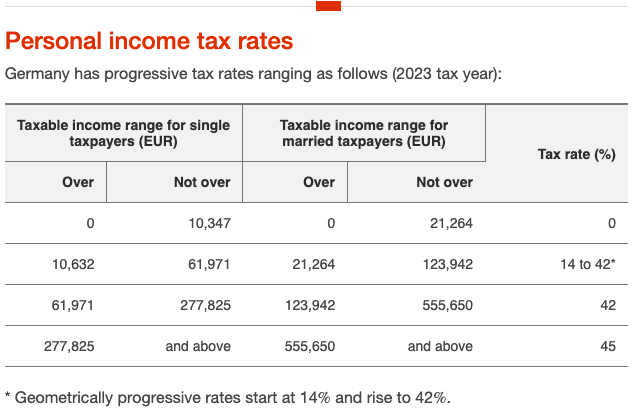

The rental income in Germany is all taxed according to the income tax brackets. See the left hand-side chart.

It’s important to note that for non-German tax residents the initial 9,744 Euro is not tax free and this would be taxed at the 14% rate.

7. Capital Gains Tax

In Germany there is no specific capital gains tax rate - you are taxed according to the income tax brackets as outlined above. However if you hold for 10 years from the point of signing the purchase agreement you are exempt from any taxes on capital gains. In Berlin, as the buyer takes on all costs associated with a purchase, you are able to exit the investment after this point tax free.

8. Can I apply for a mortgage and on what terms?

Unless you are living in any of the countries blacklisted by the EU you are virtually assured to get a mortgage with an LTV up to 60%. The typical mortgage is with an interest rate fixed for 10 years and the Loan term is flexible based on retirement age. The interest rates you receive will vary between 3.85% - 4.5% based on the size of apartment you purchase, your employment status and whether you are willing and able to travel to Germany to sign the mortgage.

9. How will I rent my apartment out?

Three months prior to completion we would reach out to you to recommend a lettings and management agency. Typically speaking we recommend clients to rent apartments unfurnished. Furnished apartments cause more hassle and costs for little extra return. Unfurnished apartments are called “cold” this means that the tenant pays for the majority of any house management fees (common area upkeep etc) and for their bills.

10. I’ve heard that the rental agreements in Germany are quite heavily weighted towards the tenant, and therefore can be quite a costly & lengthy process to remove a ‘bad tenant’?

It’s true that in Germany the rental agreements do favour the tenants more so than in some other countries. Two ways to mitigate this risk are by looking very closely at the prospective tenant before accepting, plus the type of property and location you are purchasing.

As a general rule it is rent controlled properties where you have these issues, so purchasing new build (i.e. built after 2015) properties in more affluent areas will mean there is a very low risk of any issues.

If you still have some questions unanswered, please feel free to reach out to us and a member of the Volsung team will be happy to help.